Budgeting For University as Parents

Budgeting for university isn’t just for students since many parents find themselves financially supporting their children when they take their next steps in education. Whilst there is student finance to cover living expenses – including student accommodation, bills, transport or food shopping – these can still add up.

The average student budget might surprise you because regardless of the support your child receives, it likely won’t cover all expenses. But there are, however, a number of things your family can do to prepare, free up some money and cut your child’s living expenses once they start university. This is why we’ve arranged our tips to help you get to grips on this journey.

See how much their living costs will be

Once you know what support your child is eligible for, it’s time to see how far it needs to stretch, and how much it will it cost to support them during their studies. In fact, this might sway your child’s decision about university choices, especially if their options are on opposite ends of the country.

In addition to a spending budget, have a buffer for any surprise costs that might arise, such as spontaneous trips home or say, fixing a smashed phone screen. The same goes for any one-off fees, such as their student hall deposit or membership fees for clubs/societies. It might even be a good idea to speak to current students (or their parents) to see the kind of costs that caught them off-guard.

Adjust your household budget

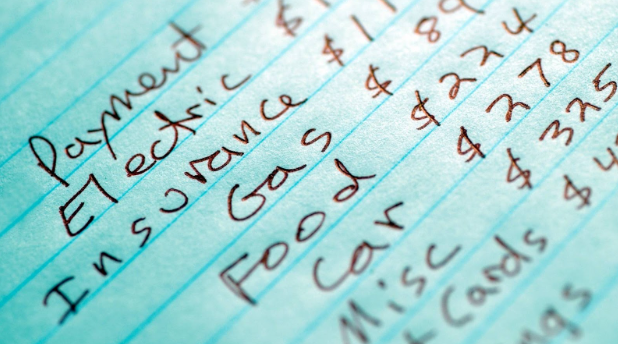

With your child going to university, this is a great opportunity to revisit your household budget to see exactly where your money is going. For example, ask yourself these questions:

- Can you put anything aside over the next year from your household budget?

- Where can you squeeze some extra money from?

- What small changes can you make now that will make a big difference?

Think about it this way – could you skip that daily coffee on the go or take leftovers in for lunch rather than spending money on food? Once you’ve calculated how much money you have before your child starts university, you’ll certainly be convinced by the total saved when budgeting for university as parents.

Make the most of student bank accounts

A lot of banks provide special student offers or generous freebies for student bank accounts, but it’s important to make sure that your child chooses one they’ll actually benefit from (without forcing the issue, of course).

For example, if you’re paying for your child’s journey back and forth between uni and home, it may be worth them opting in for an account that offers a free railcard or at least one with a student discount. Annually, you both can save so much money with this initiative and it is a great option whilst they’re away.

Apply for extra student finance funding

Whilst your child can apply for student finance up to 9-12 months after the start of their course, there’s a recommended deadline to ensure their finance arrives in time for the start of the term. And as their parent, you’ll need to provide information about your household income when sponsoring their application.

As well as the maintenance support they’re automatically eligible for,; your child can apply to get extra funding. A lot of the time, you can consent for your household income information to be shared with their UCAS choices, where the institution would then get in touch with any relevant scholarships or bursaries they offer.

Pass on life skills that can save money

Sharing the secret to your infamous carbonara and other delicious, easy home-cooked meals will keep your hungry child out of pricey meal deal aisles, or becoming too close with the local takeaway.

Take them to food shops to teach them how to shop smart. Show them a sewing technique or two to keep their favourite trousers around for longer. Give them the opportunity to do a DIY task so that they can take that lesson with them once they’ve moved.

Here’s a university budgeting tip: get them into these habits now so they know what to do, rather than right before they leave when they’ll have a million and one things to think about already.

Leave some things until the last minute

This might sound counterintuitive, but it’s actually quite an important thing to remember. One flat doesn’t need three kettles, so on the kitchenware front, it’s good to see if there are any appliances that can be used communally. Instead, it’s good to pack newbie students with items that are useful in multiples, such as toilet paper or cleaning supplies.

Find fairly priced accommodation

Of course, looking for fairly priced accommodation is essential when budgeting for university. The reason this is so important is that it will save your child a lot of money for their potential outgoings. That’s why at St George’s Tower, we pride ourselves on providing the best in accommodation, all the way from price to room quality.

Be sure to check out our deluxe and premium studios, and if you think you’ve found the one, go ahead and make a booking with us!

For any questions or queries, please don’t hesitate to get in touch – our team is always happy to assist with anything you want to know. Alternatively, you can check out our blog to see the latest updates and tips we provide.